Like every year, Knight Frank has published its Prime Ski Property Report. It offers a detailed assessment of the luxury alpine real estate market in the French and Swiss Alps for 2020. This data is valuable to better understand the developments in the top 5% of the region’s real estate market. In this article, we summarize the report’s main conclusions.

Alpine real estate buying: profitable investments

According to the International Report on Snow & Mountain Tourism, there was a 10.6% and 5.3% respective increase in visitors to the Swiss and French Alps between 2018 and 2019. In the luxury real estate market, this growth has translated into strong rental demand, stable sales, and rising prices at most resorts.

Investment in a ski resort is becoming more and more rational. Typically, few buyers benefit from double-digit annual capital growth For premium mountain residences in the Swiss and French Alps, statistics for the past decade show an average annual growth of 19%.

In addition, Alpine buyers have various advantages: easy access to the real estate market, low mortgage rates, almost guaranteed rent, stable or even rising prices, a sufficiently liquid market to facilitate their eventual exit, and a monetary advantage (the Euro and the Swiss franc being strong currencies).

Significant changes in the Swiss Alps’ real estate market

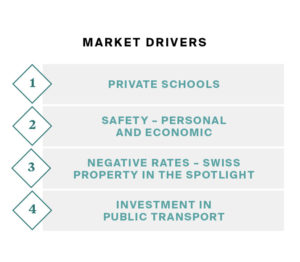

In the Swiss Alps, several recent developments have taken place:

- The Swiss National Bank has adopted negative interest rates. As a result, wealthy residents who want to stay in the country buy ski resorts to preserve their heritage, while enjoying a gross yield of around 2.5%. Thereby, the share of local buyers has increased in Switzerland.

- The legislation strongly impacts the stations. The volume of sales, the price, and the type of properties available vary greatly depending on the category of residence (main or secondary).

- In addition to being ski resorts, Gstaad, Villars, Crans-Montana, Verbier and St Moritz also host private schools. Villars, for example, hosts more than 800 students, notably at the Alpin Beau Soleil College which has recently grown. The resorts thus have many permanent residents, who represent buyers, tenants, and a workforce.

- Thanks to flexible work and the installation of 4G in the Swiss Alps, more and more Swiss citizens have gone back to living in the mountains and working from home. In addition, resorts invest a lot to develop their equipment,while offering multiple social and sporting events. Thereby, having a primary residence in the Alps is a perfectly viable option.

Developments on the French Side of the Alpine Real Estate Market

Changes have also affected French resorts:

- In 2008, half of the clients opted to rent a ski residence; it became the choice of the vast majority in 2019 because of the stay’s profitability.

- Buyers prefer to renovate existing buildings rather than buy new ones. This preference results from the advantages linked to the 20% reduction in VAT and transfer taxes in the event of a property sale.

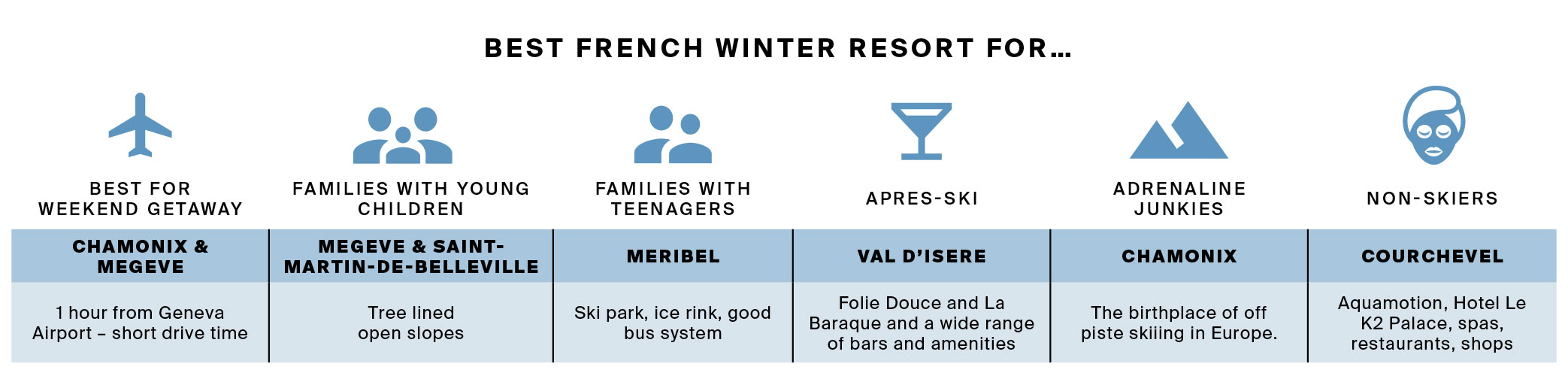

- Public investment remains essential for buyers.French resorts therefore continue to renew and develop their infrastructure: new gondola lifts, plans for the Alpine Skiing World Championships, modernization of ski lifts, construction of new luxury hotels, etc.

- The number of Scandinavian buyers has increased in Chamonix and some Swiss buyers have appeared in the resorts closest to Geneva. In Courchevel, Chinese rental demand has increased sharply.. Tourism is a sign of a potential increase in real estate demand in the future.

What changes are expected in the Alpine real estate market in 2020?

To stay in step with the evolution of consumption habits, ski resorts are constantly reinventing themselves and will continue on this path.Many already stand out as poles of luxury brands in their own right. They achieve this through their hotel, commercial and / or thermal offer, which attracts a new type of tourist, unfamiliar with the ski slopes. This trend will certainly continue.

In addition, it is likely that Brexit-related currency fluctuations will also affect the Alpine real estate market. Indeed, the value of the pound sterling could increase significantly following the December 12, 2019 elections. For example, if its value went from € 1.18 to € 1.35, a British buyer would benefit from savings of £ 121,000 for a million Euro chalet. With such opportunities, the influx of UK buyers could change the state of the market.

Conclusion

In summary, the forecast for the Alpine real estate market in 2020 is characterized by healthy rental demand, low mortgage rates, and large resort-oriented investments. Combined, these elements support the demand.