Knight Frank has published its annual Ski Property Report. It offers a detailed assessment of the luxury alpine real estate market in the French and Swiss Alps at the start of 2021. In a world marked by Covid-19, it is interesting to see the impact of the pandemic on attitudes and demand for alpine real estate. In this article, Gérance Service summarizes the report’s main conclusions for you.

Results of the 2020 Alpine Index

This index tracks the evolution of Alpine luxury real estate prices based on the value of a 4-bedroom chalet located at the heart of the 19 main resorts in the French and Swiss Alps. The report estimates that:

- Overall, the index registered an increase of 1.2% compared to 2020 (index 2019: 1.4%). The pandemic therefore only had a slight impact on prices.

- The change in the index at Villars is 0.00%, which means that the prices of the luxury segment have not been impacted in any way. This sets it apart from other Swiss resorts of Crans and St-Moritz where prices have fallen, due mainly to a high stock of properties on the market.

- Villars-sur-Ollon is located in 13th position in terms of price per square meter, with a value of 12’300 €/m2.

- It is noted that international buyers are inclined to consider Switzerland as a permanent base, thanks to its management of the health crisis as well as to the lifestyle it offers.

- In these uncertain times, the Swiss franc is the most stable currency in the world.

- Negative interest rates increase the attractiveness of property, because they mean that Swiss banks charge their clients for the uninvested capital: real estate investments therefore seem preferable, in order to preserve assets.

Results of the Knight Frank Luxury Investment Index, based on a four-bedroom chalet located at the center of a resort. Annual variation in% until the 2nd quarter of 2020.

Covid-19’s Impact

Observations:

- Resorts missed out on the lucrative Easter period due to their closure in March 2020: lifts were stopped, and containment measures were put into place.

- Drone and virtual tours were put in place.

- Swiss hotels have experienced a period of full occupancy during the summer, and rental demand has increased. This trend continued though to the autumn.

- Switzerland has been declared “the safest country in the world”.

- Residents of Geneva, Lausanne, and Montreux have moved into their second home as working from home has become the norm.

- Sales continued throughout the pandemic.

How has Covid-19 increased the attractiveness of life in the mountains?

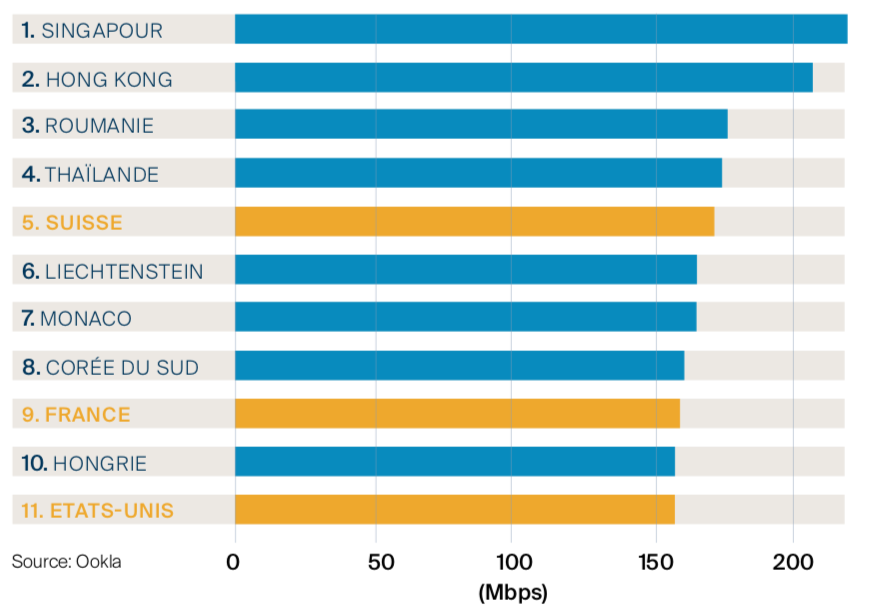

Moving and working from home in the mountains? Fixed broadband connection speed, August 2020.

The Alps are more popular than ever with buyers who care about their health and well-being. The Alps, already synonymous with space, freedom, and adventure, benefit from the growing importance given to well-being. This leads to a disappearance of the distinction between main and secondary residence, as more buyers want their mountain home to be their main residence.

Buying in the mountains for rental investment

- 90% of buyers now choose to rent their ski residence, up from 65% in 2005. It is therefore important to focus on location and certain other features, to maximize income. Knight Frank observes that:

- The residences that generate the highest incomes are small properties and one to three bedroom apartments. Mid-range cabins also offer good returns. Occupancy rates vary from 20 to 30 weeks per year.

- In Villars, rental values are more affordable in the winter, but occupancy rates are becoming higher in the summer.

To assess a good investment, Knight Frank establishes the following criteria:

- Reliable rental income

- Long-term capital appreciation: resorts with a solid investment plan for the next 5-10 years

- Vacation periods: high altitude resorts will have longer ski periods, but the low altitude resorts offer more amenities and benefit from summer tourism

- Market liquidity: possibility to sell if necessary

- Efficient management company

- Easy access: near an airport, access by road from urban areas

- Stable currency

- Dynamism of the resort: sports, gastronomy, music, cultural events

- Low cost of operation, maintenance, and rental

- Resorts with an international profile, that do not depend on a single nationality/economy

In Switzerland, the 4 main market drivers are:

- Excellent healthcare system

- First class education

- Personal security

- Economic stability and monetary refuge

Trends for 2021

1. Implications of Brexit

Since January 1, 2021, British citizens now need a visa to enter the EU. However, since Switzerland is not in the EU, UK owners of Swiss ski residences should be less affected. This could boost demand for Swiss real estate. The laws enabling foreign buyers to purchase in Swizerland were already updated to enable UK passport holders to keep buying as if they were still in the EU.

2. The currency game

Changes in exchange rates can generate significant changes in the purchasing power of foreign buyers. 2020 has already seen significant volatility, and the US election, Brexit, and the pandemic are expected to increase instability in the coming months. The Swiss franc, as a stable currency, could benefit Swiss resorts.

3. Design and technology

With an increase in working from home, housing will also have to adapt to allow owners to have space both to live and work.

4. The rise of the 50/50 household

Buyers wishing to make their mountain residence their main residence are more demanding on equipment: home office, outdoor spaces, faster broadband connections, and movie theaters or smart technology are increasingly in demand. In Switzerland, the number of dwellings classified as main residences could fall below the 20% ceiling imposed by the Lex Weber, allowing the creation of new real estate promotions for the first time in more than ten years.

5. Long-term rentals are the source of future sales

Long-term rental requests have increased thanks to the development of remote work and the announcement of new restrictions. This allows interested people to test the process, with the inclusion of a “purchase option” clause in the rental contract. Rent competes with prices in London, New York, or Geneva.